For latest news / information have a look at our LinkedIn page

The impact of the JIBAR reform on market risk

This article focuses on the interaction between the JIBAR transition and market risk dynamics, in particular on (but not limited to) valuation impacts across Mark-to-Market estimates, risk measurement and valuation adjustments; market risk quantification methods (i.e. FRTB); model risk; hedging, and operations

ECB Consultation on Risk Data Aggregration and Risk Reporting - July 23

Our summary of the recently published ECB Guide on effective risk data aggregation and risk reporting.

ECB Consultation on Risk Data Aggregration and Risk Reporting – July 23

ECB Guide to internal models - June 2023 Update - Part 2 Credit Risk

Our interpretation of the proposed updates to the Credit Risk chapter in the ECB´s recently published Guide to Internal Models.

ECB Guide to internal models – June 2023 Update – Part 2 Credit Risk

ECB Guide to internal models - June 2023 Update - Part 1 General Topics

Our interpretation of the proposed updates to the General Topics chapter in the ECB´s recently published Guide to Internal Models.

ECB Guide to internal models – June 2023 Update – Part 1 General Topics

Proposed updates to Non-retail Exposures (Part 2)

Our interpretation of the proposed updates to Non-retail Exposures (Part 2) in the PRA’s recently published consultation paper (CP 16/22) covering the implementation of the Basel 3.1 standards.

Proposed updates to Non-retail Exposures (Part 1)

Our interpretation of the proposed updates to Non-retail Exposures (Part 1) in the PRA’s recently published consultation paper (CP 16/22) covering the implementation of the Basel 3.1 standards.

Summary CP 16_22 Implementation of B3.1 Standards - Permission to use IRB approach

Our interpretation of the proposed updates concerning the Permission to use the IRB Approach and Related Requirements in the PRA’s recently published consultation paper (CP 16/22) covering the implementation of the Basel 3.1 standards.

Summary CP 16_22 Implementation of B3.1 Standards – Permission to use IRB approach

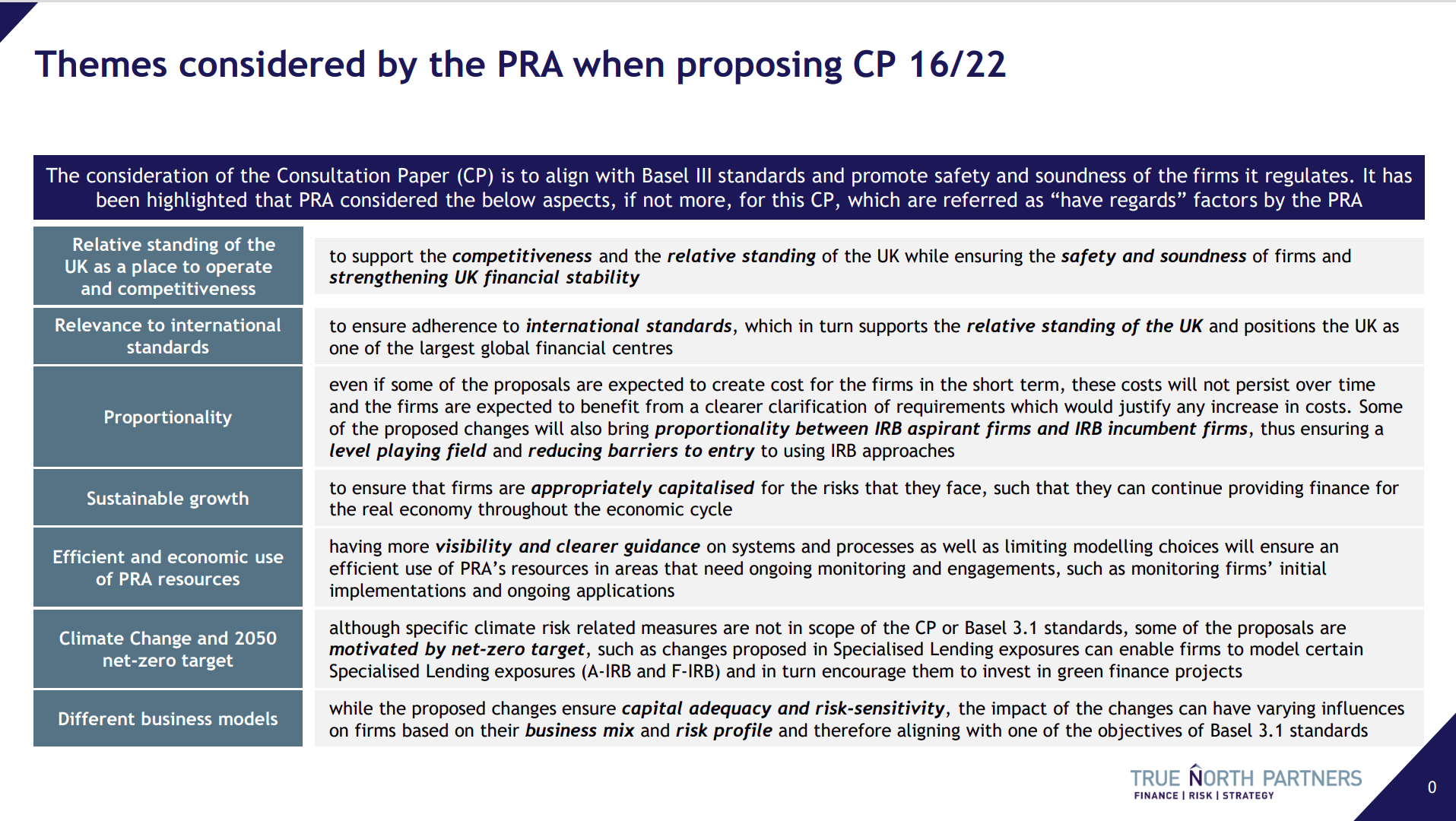

Considerations by the PRA when developing the proposals set out in CP 16/22

The proposals set out in the consultation paper aim to advance the PRA’s primary objective to promote the safety and soundness of the firms that it regulates and the secondary objective of facilitating effective competition. In developing the proposals set out in this consultation paper, the PRA has had regard to the FSMA regulatory principles, the aspects of the Government’s economic policy set out in the HMT recommendation letter from 2021 and the supplementary recommendation letter sent in April 2022. Where the proposed new rules are CRR rules (as defined in section 144A of FSMA), the PRA has also taken into consideration the matters to which it is required to have regard when proposing changes to CRR rules. This summary page provides an overview of the main considerations by the PRA when developing the proposals set out in CP 16/22.

Considerations by the PRA when developing the proposals set out in CP 16/22

Summary CP 16_22 Implementation of B3.1 Standards for Specialised Lending

Our interpretation of the proposed updates to Specialised Lending Exposures in the PRA’s recently published consultation paper (CP 16/22) covering the implementation of the Basel 3.1 standards.

Summary CP 16_22 Implementation of B3.1 Standards for Specialised Lending

TNP White Paper discussing the 31 December 2021 #libortransition date

Our Partner Periklis Thivaios has published a TNP White Paper discussing the 31 December 2021 #libortransition date, as well as a number of topics that still dominate the transition discourse.

TNP White Paper on IBOR transition dates and the impact of Covid-19

With the Basel Committee announcing the deferral of the Basel III implementation

timelines by one year,1 the rumours around and calls for an extension of the Libor

transition implementation timelines are getting louder.

On the 29th of April, the UK Risk Free Rate Working Group (RFRWG), the FCA and the Bank of England issued a joint statement extending the interim transition deadline for the issuance of Libor linked loans in the UK from end of Q3 2020 to end of Q1 2021.2

This latest joint statement comes in addition to the one issued on the 25th of March, whereby the three bodies emphasised that “it remains the central assumption that firms cannot rely on LIBOR being published after the end of 2021.” 3

TNP White Paper – IBOR in the time of Corona – revised May 2020

Sustainability factors in risk and bank management: Banks are facing new regulatory and social challenges

Sustainability has rapidly and finally developed from a niche existence to one of the most important influencing factors of the financial system. Even before the “green deal” was announced, the topic had increasingly been fleshed out by the EU Commission, EBA, BaFin and other national regulatory authorities. Although the current regulation initially focuses on climate and environmental aspects, more extensive requirements will follow. Regulatory interventions in other sectors will indirectly gain an ever increasing influence on banks. Due to the high relevance, each institute should develop a holistic approach that is tailored to its own business model.

Written by Prof. Dr. Wolfgang Malzkorn and Constantin Ebert

Nachhaltigkeitsfaktoren in Risikomanagement und Banksteuerung

Risk South Africa in Cape Town - 13th of November (https://events.risk.net/risksouthafrica)

The reference rate reform and the associated transition are considered as some of the broadest-reaching changes in the financial system since the global financial crisis. Graham Bruce, Associate Partner at TNP, will be leading the discussion at the IBOR panel for the 2019 Risk South Africa conference.

TNP White Paper on IBORs, ARRs and transition considerations

by Dr. Periklis Thivaios, CFA, FRM - Partner at TNP and Co-authors: Graham Bruce (associate partner at TNP), Vijay Krishnaswamy (partner at TNP), Niru Govender (senior consultant at TNP)

In the aftermath of the last financial crisis, it came to light that many of the interbank offered rates (IBORs) used for pricing financial instruments, loans and transactions were no longer fit for purpose.

As a consequence, the UK’s FCA and the US’s CFTC have simultaneously announced the discontinuation of IBORs post 2021 prompting the industry, regulators and trade bodies to engage on proposed replacement rates.

In parallel, several other regulators (including South Africa’s Reserve Bank) have initiated consultative processes for the migration or reform of existing reference rates to ones that are consistent with the IOSCO principles and the EU’s Benchmark Regulation (BMR).

The path towards Alternative Reference Rates (ARRs) is fraught with uncertainties:

1. What Risk Free Rates (RFRs) will be used in countries such as South Africa?

2. How do we develop term RFRs that comply with the IOSCO principles?

3. What are the operational, legal, risk management and client management implications of the transition?

For more information please contact: sonja.haug@tnp.eu

Risk Minds Asia, Hong Kong, October 2019

Presentation by Dr. Periklis Thivaios

Digital currencies, cryptos and the future of money

12th Annual ACFE Africa Fraud Conference hosted by the ACFE SA 2019

It is recognised as the largest anti-fraud event in Africa, and second largest in the world. We aim to bring together 1000 + anti-fraud professionals from more than 20 countries over three days, all with a shared desire to gain leading-edge knowledge, explore the newest resources for fighting fraud to achieve their goals more effectively, and meet fellow professionals within Africa expanding their network. The Conference program is carefully structured every year to include presentations and workshops by leading experts on fraud and corruption, and related fields. The content is topical, relevant and exciting.

Adding to the theme, panellist Andries Schutte, director Riskscape and partner at True North Partners, said, technology played a profound role in shaping the global risks landscape. “Concerns about data fraud and cyber-attacks remain prominent, along with technological vulnerabilities.” Some of the concerns Schutte listed included, “increased risk of identity theft; massive data breaches and the potential criminal uses of artificial intelligence; and difficulties introduced by regulations particularly those governing Financial Services.

Risk Minds Americas, Boston USA, September 2019

Presentation by Dr. Periklis Thivaios

CRYPTOS, AML AND FINANCING OF TERRORIST ACTIVITIES – PROACTIVE AND PREVENTION STRATEGIES FOR REGULATED FINANCIAL INSTITUTIONS

Crypto characteristics and their potential impact on AML / FTA

Towards a digital money future – privacy, monitoring and other regulatory considerations

What can financial institutions and regulators do to minimise the use of cryptos for AML?